Decades of Trust. Now Supercharged with Cloud

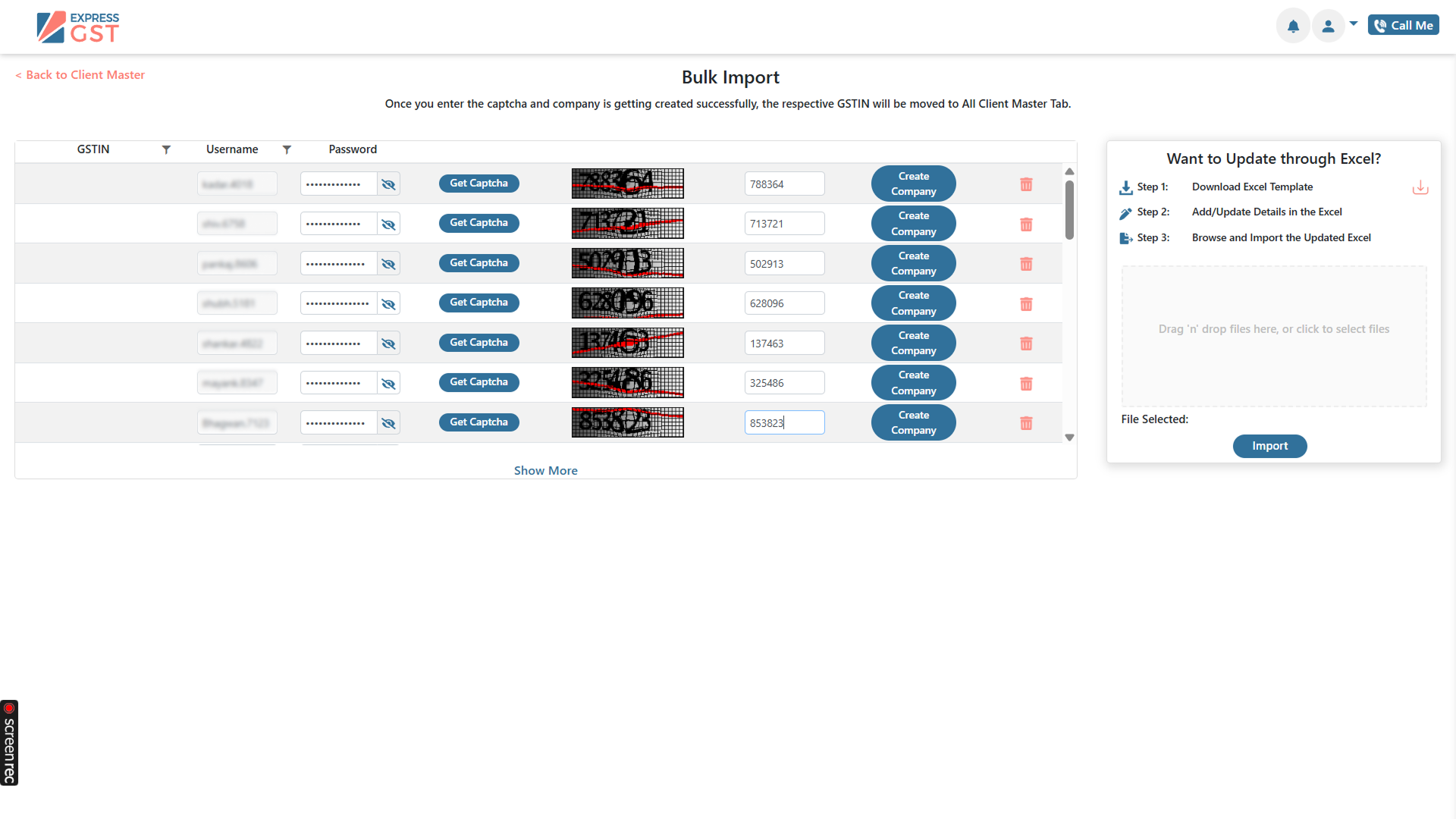

GST, ITR & TDS - All in One Tax Cloud Software

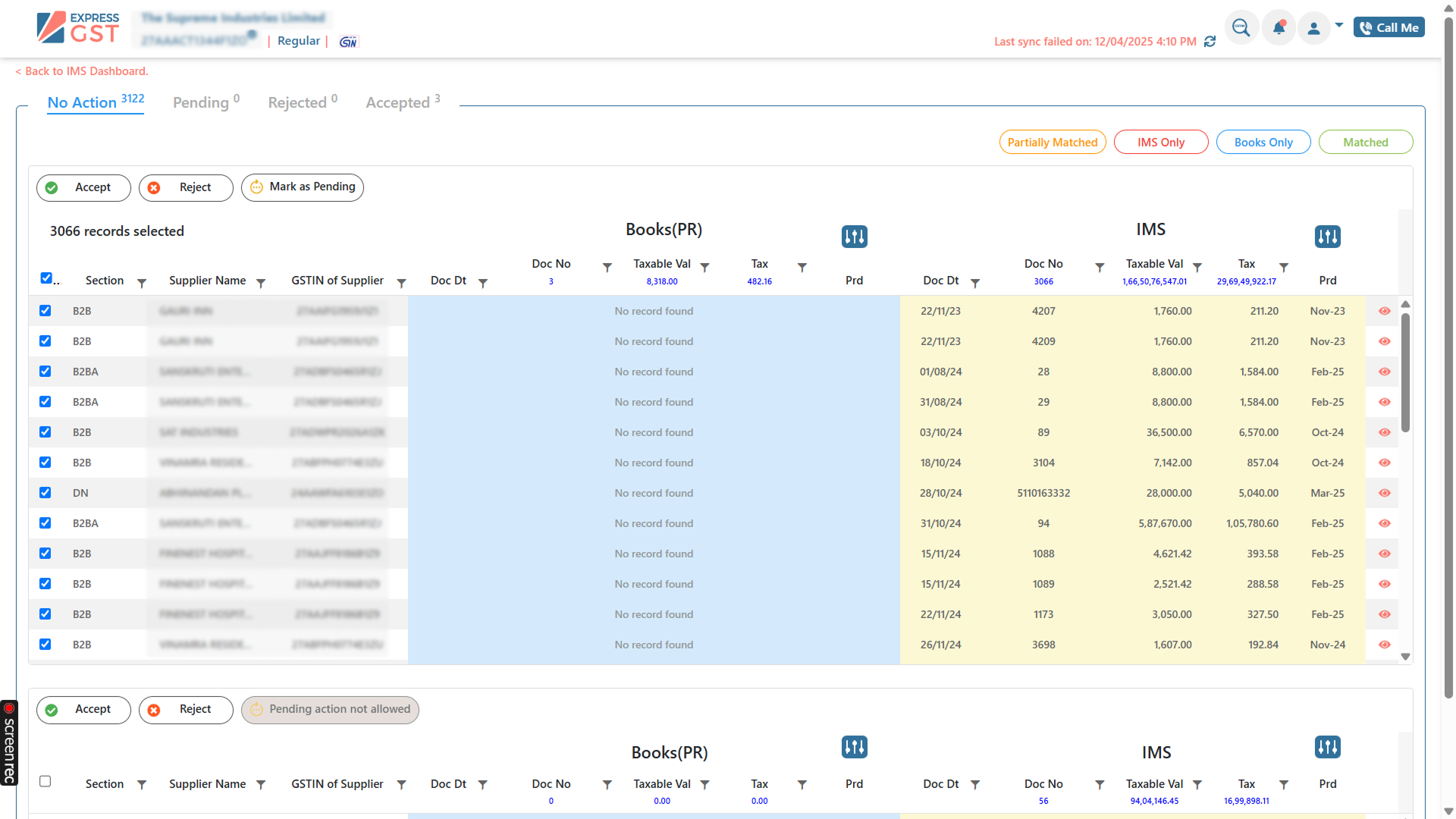

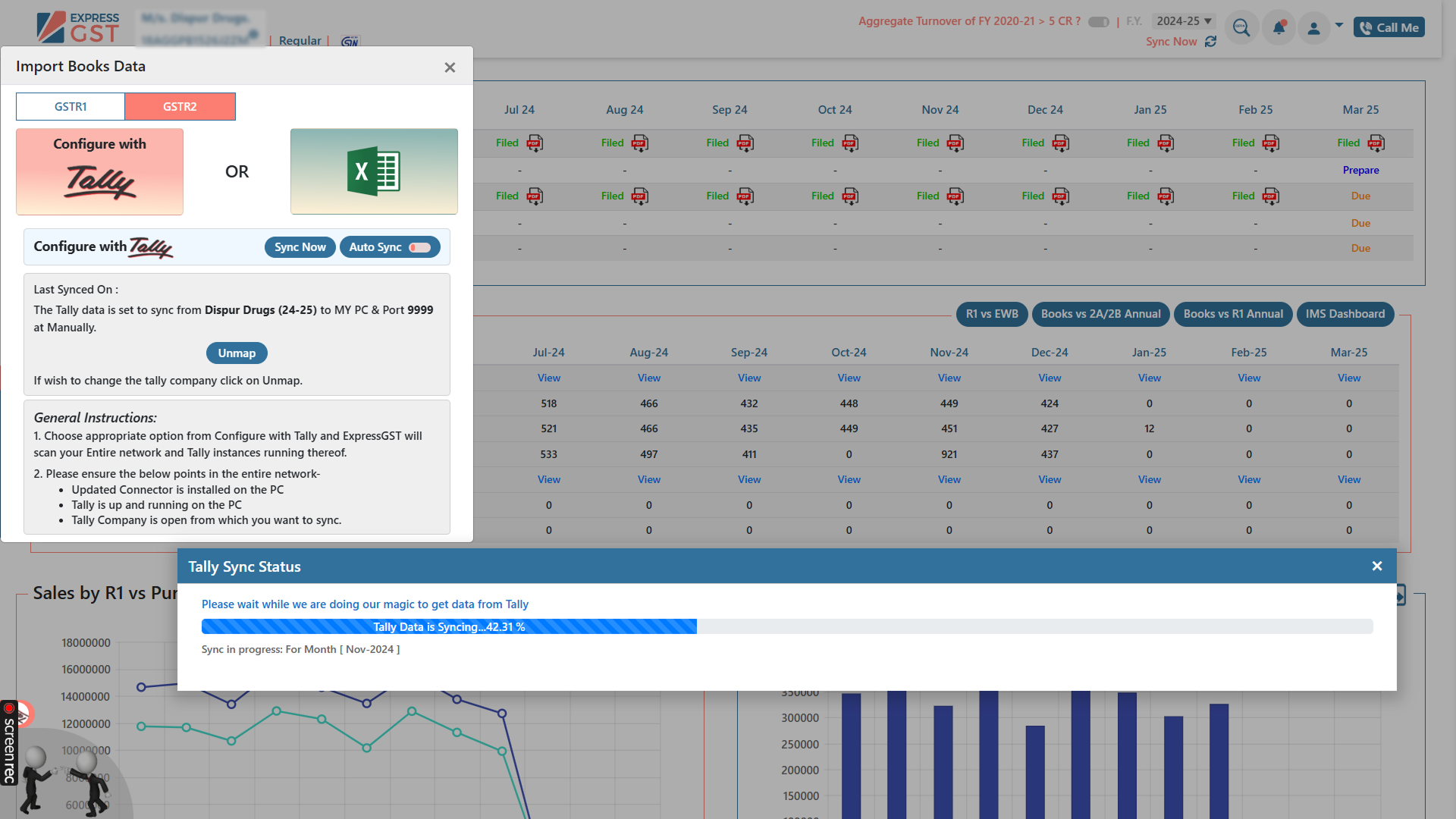

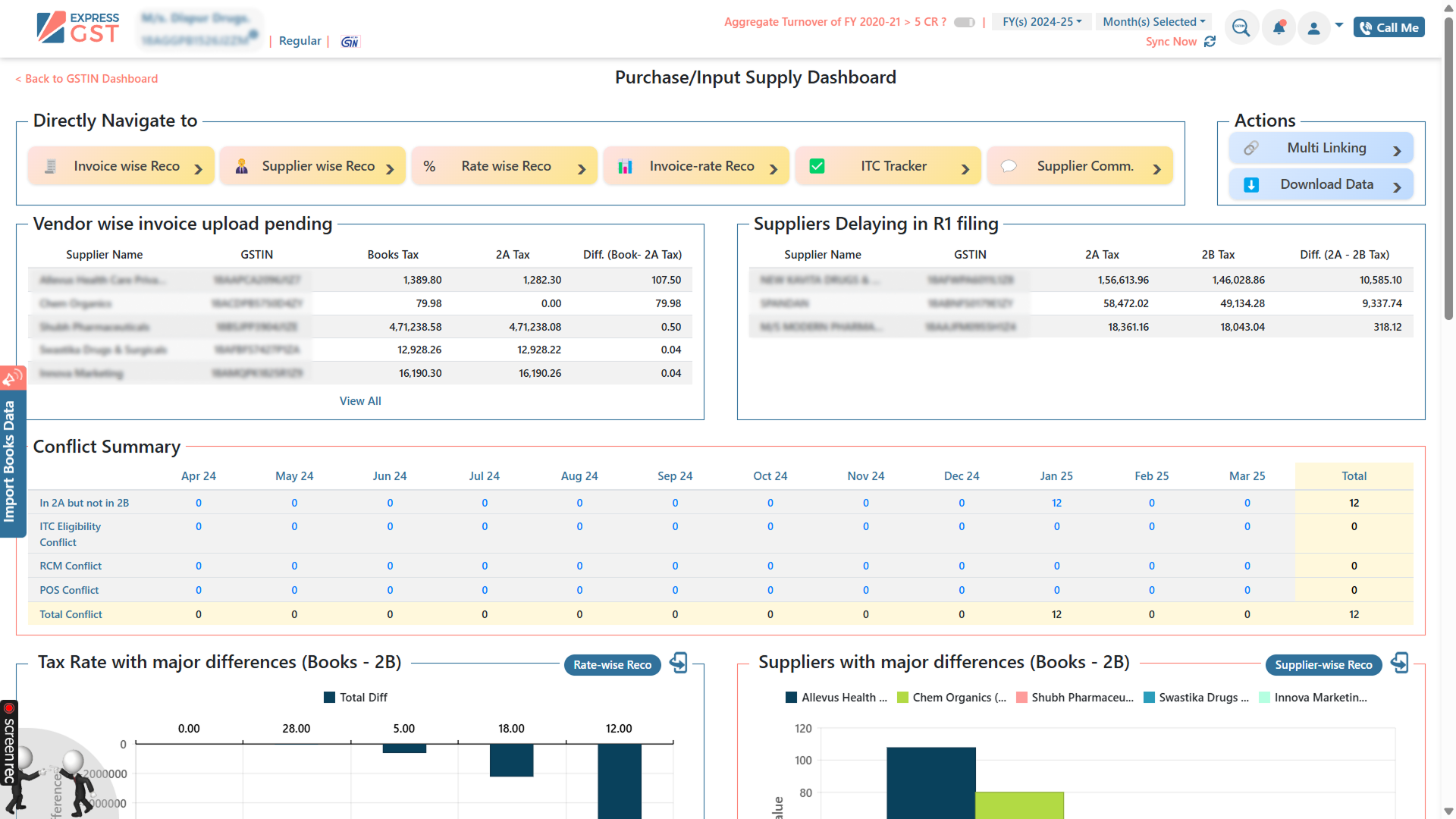

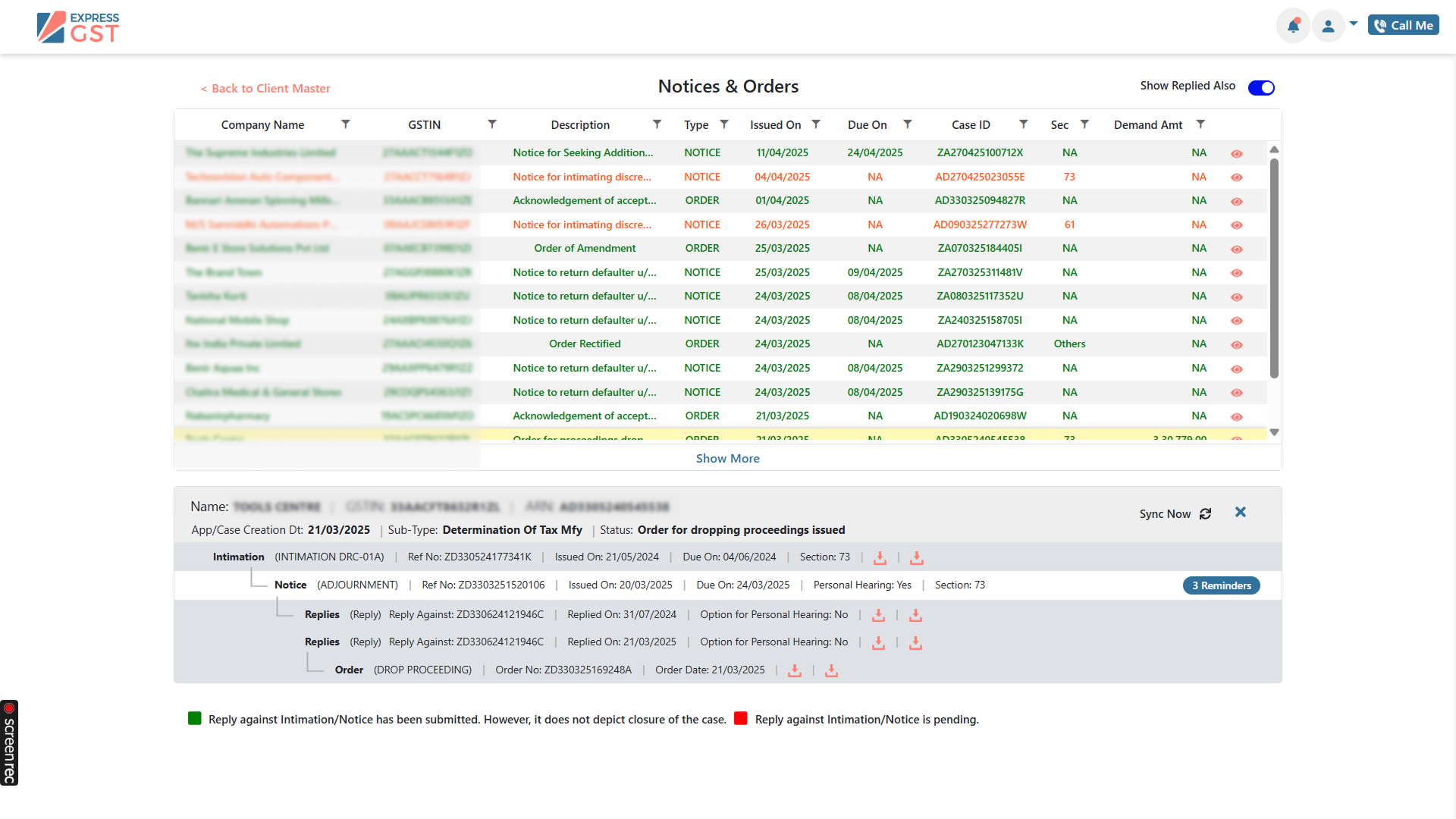

GST Notices, End-to-End Compliance or Schedule & Send 2A/2B data or Auto Sync Tally Data - All Possible

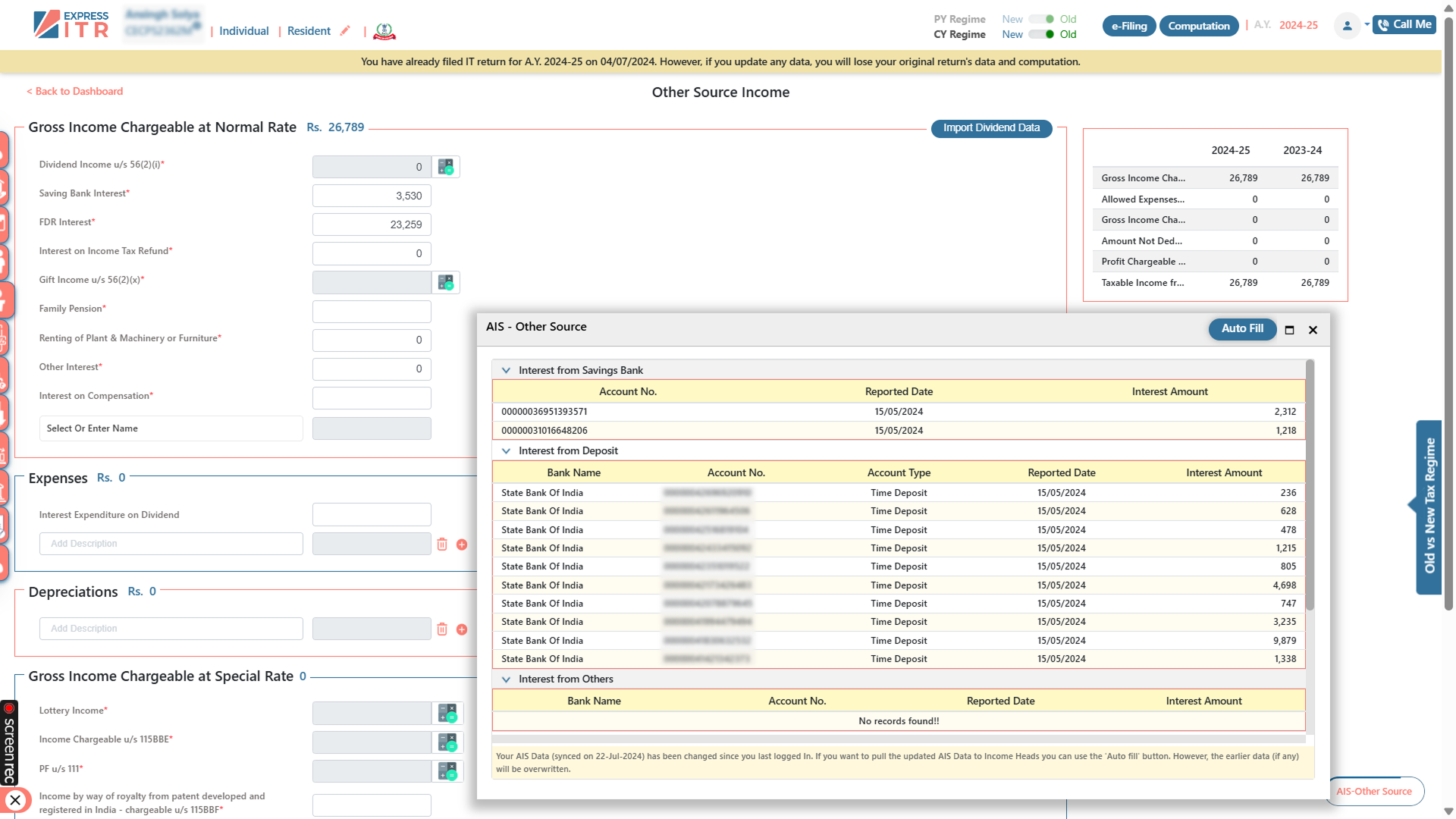

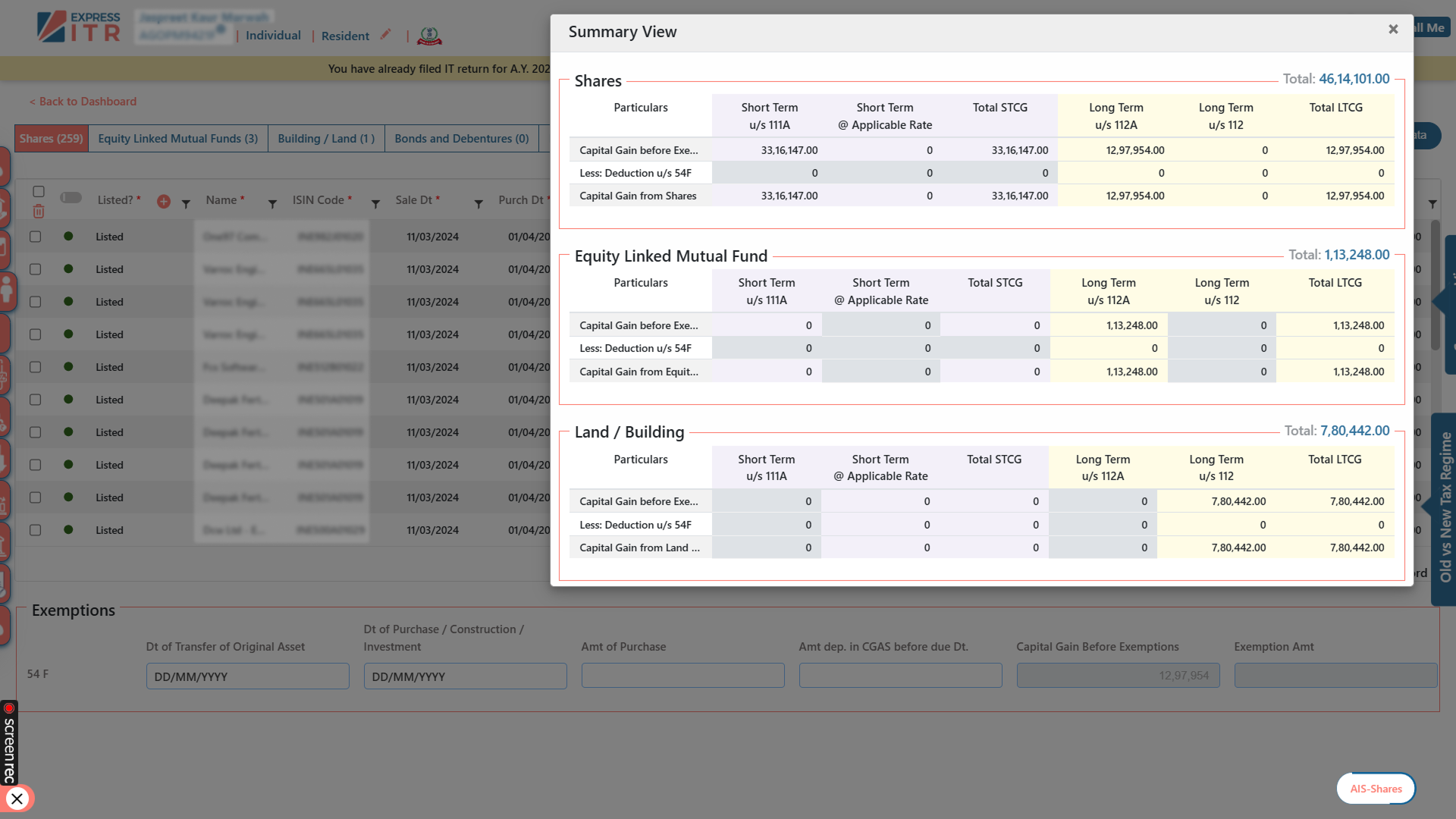

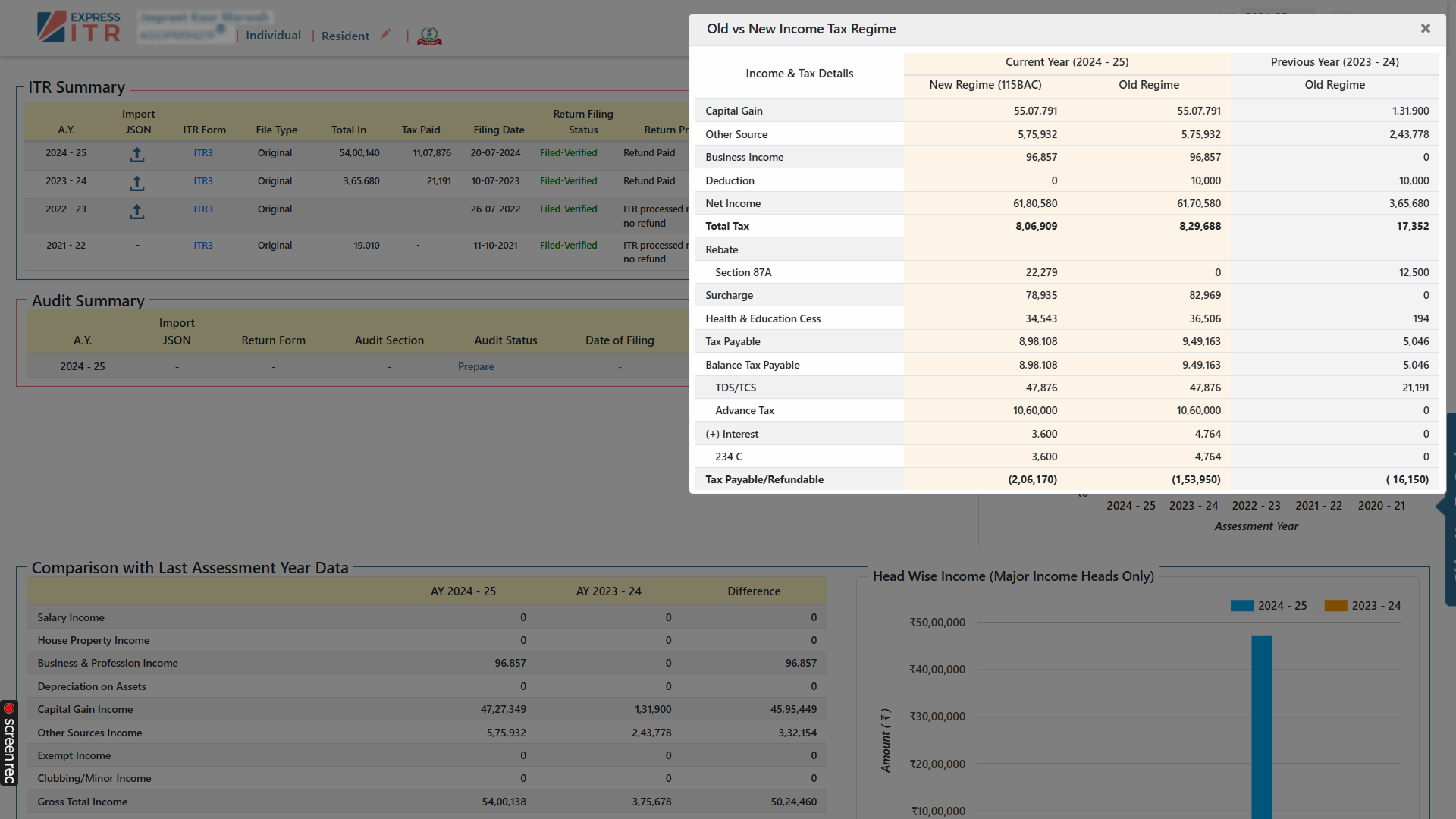

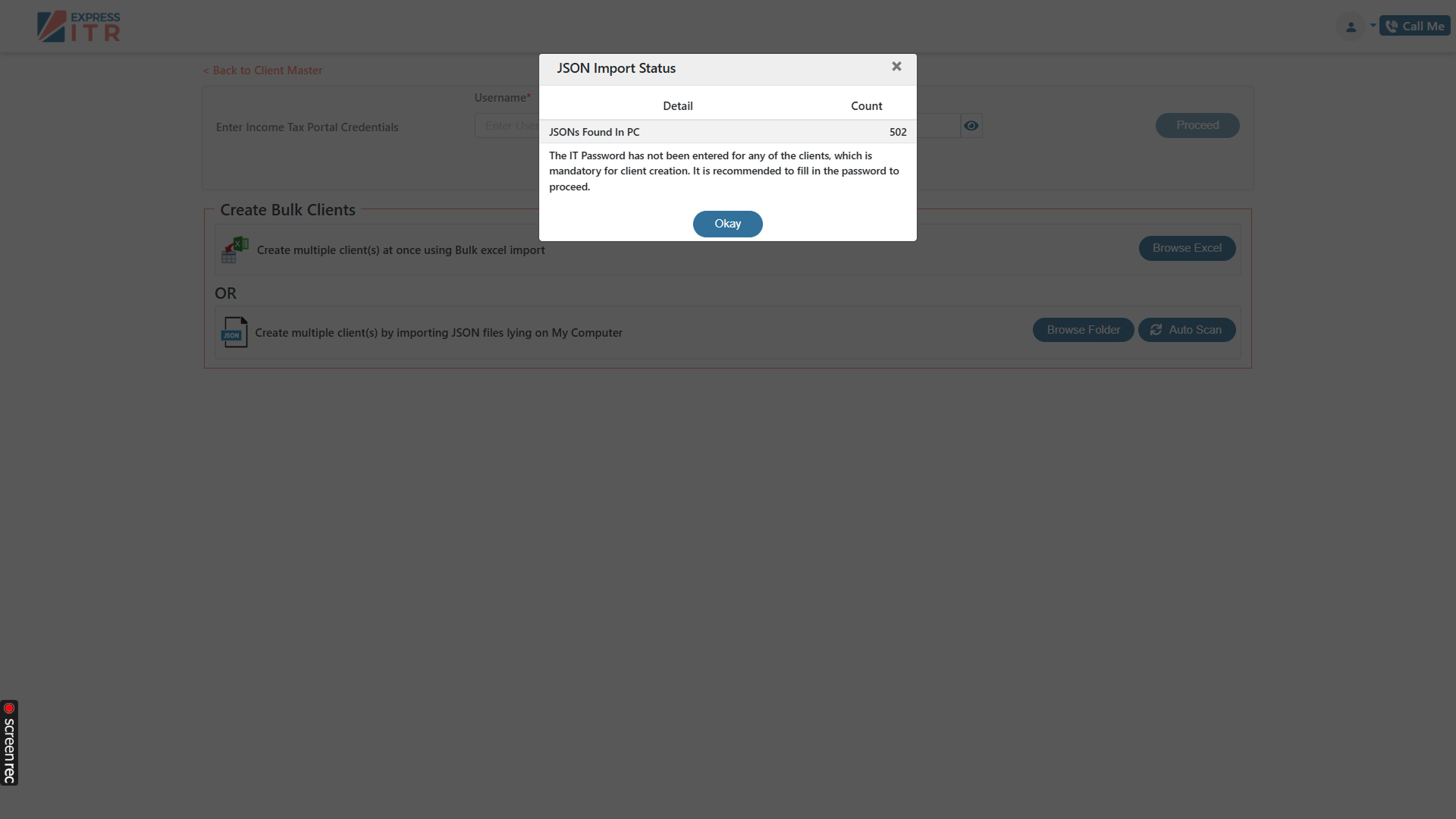

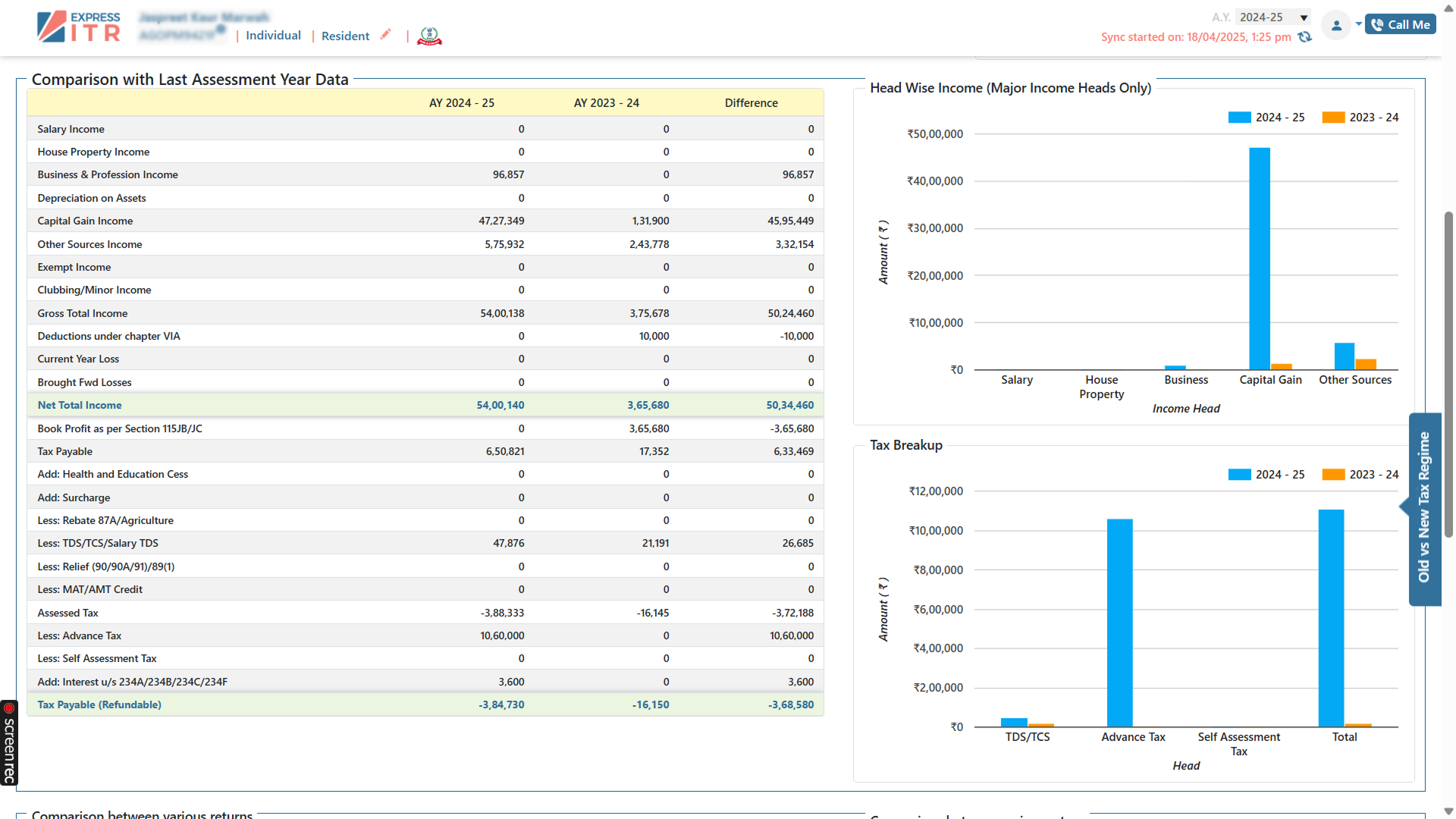

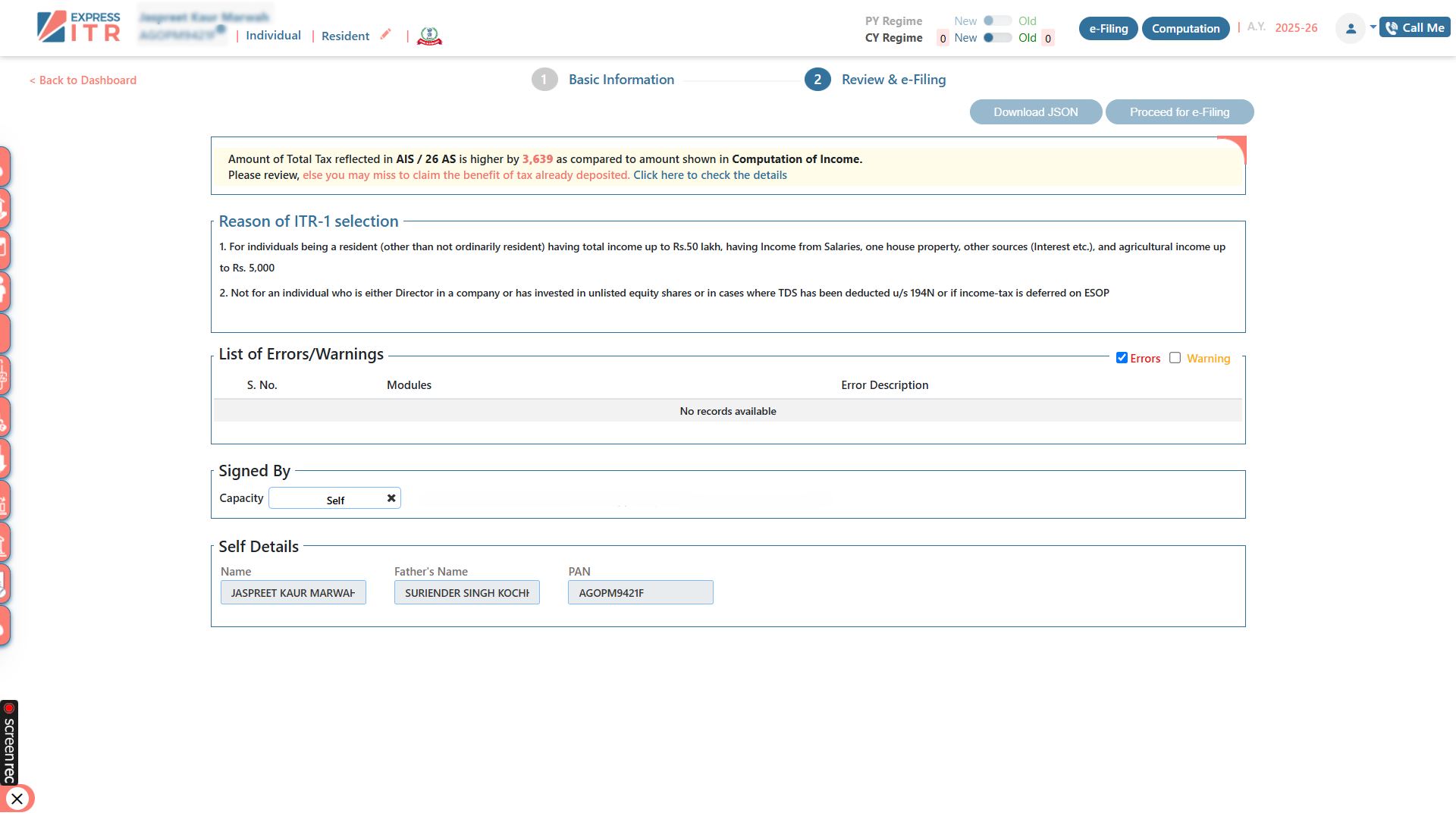

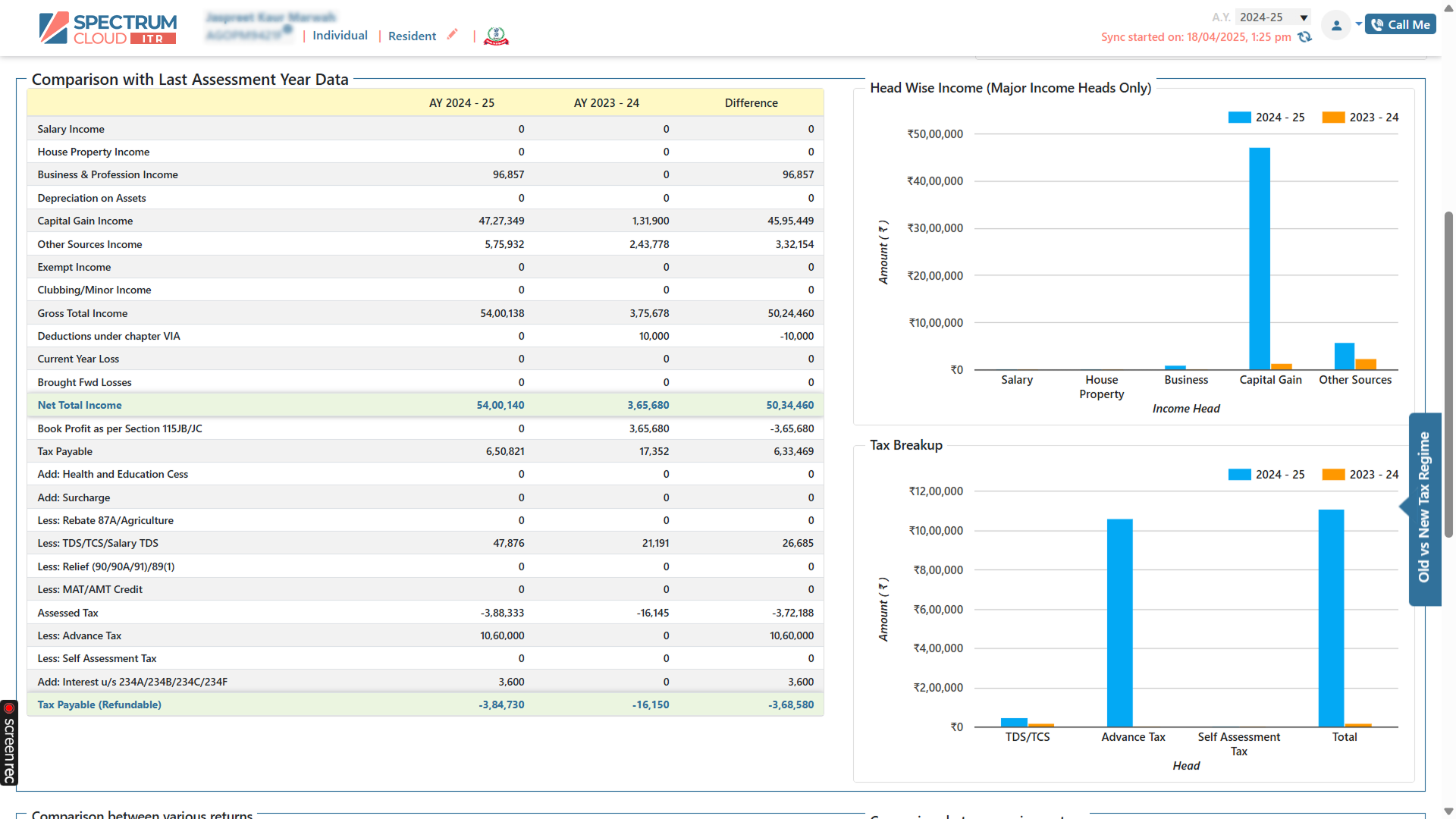

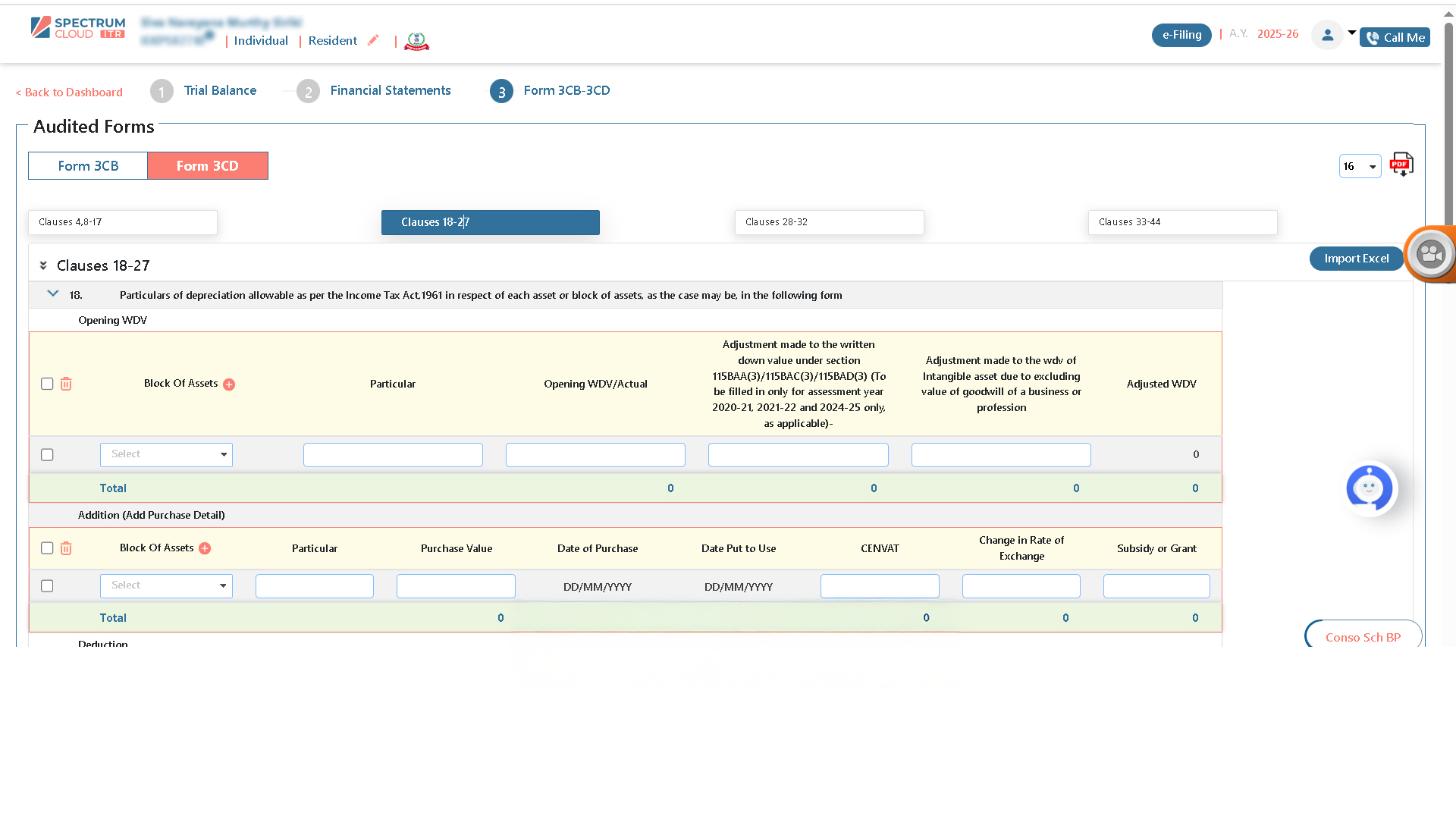

Simplify ITR Filing for All Clients, From ITR 1 Through 6

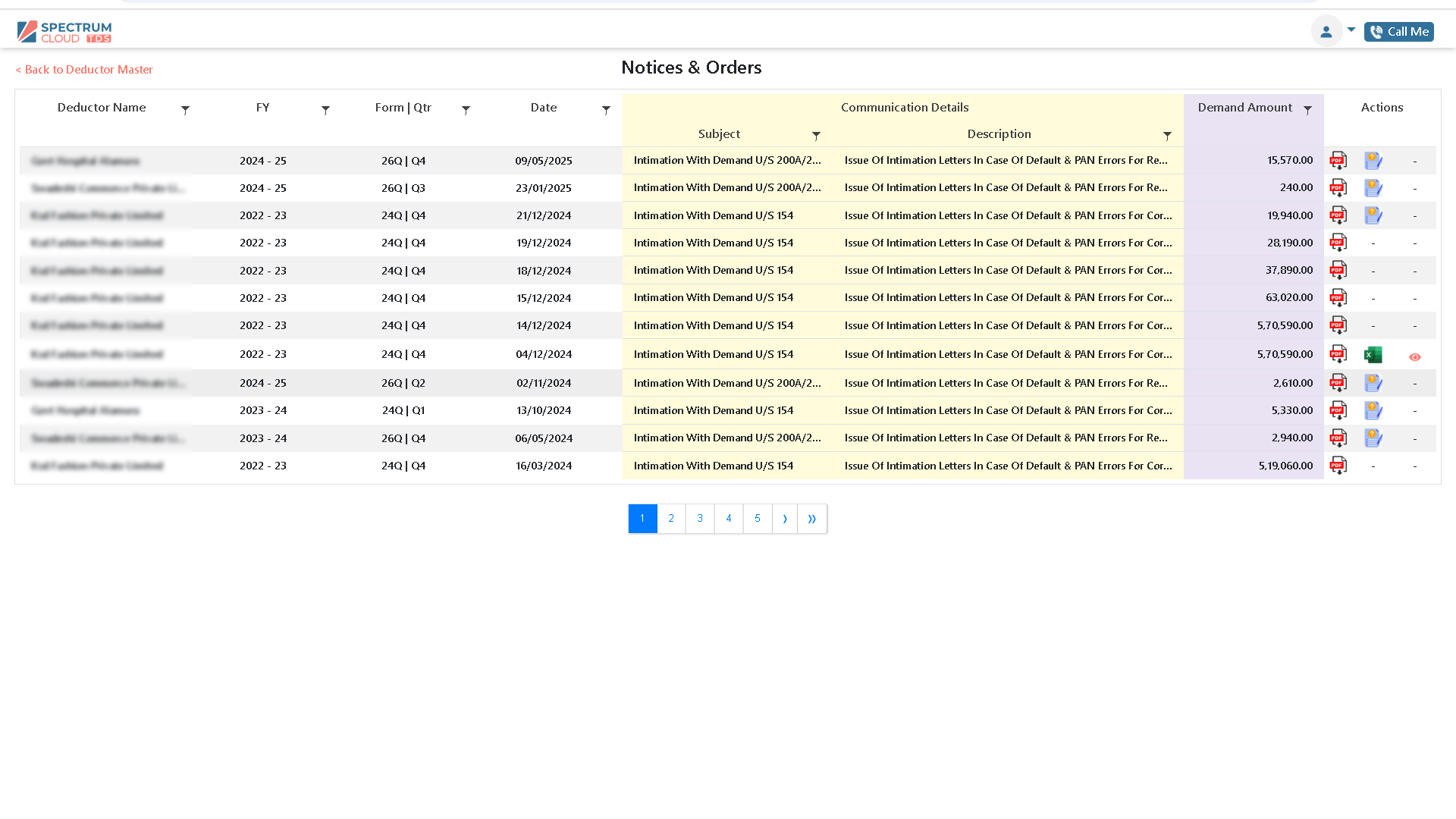

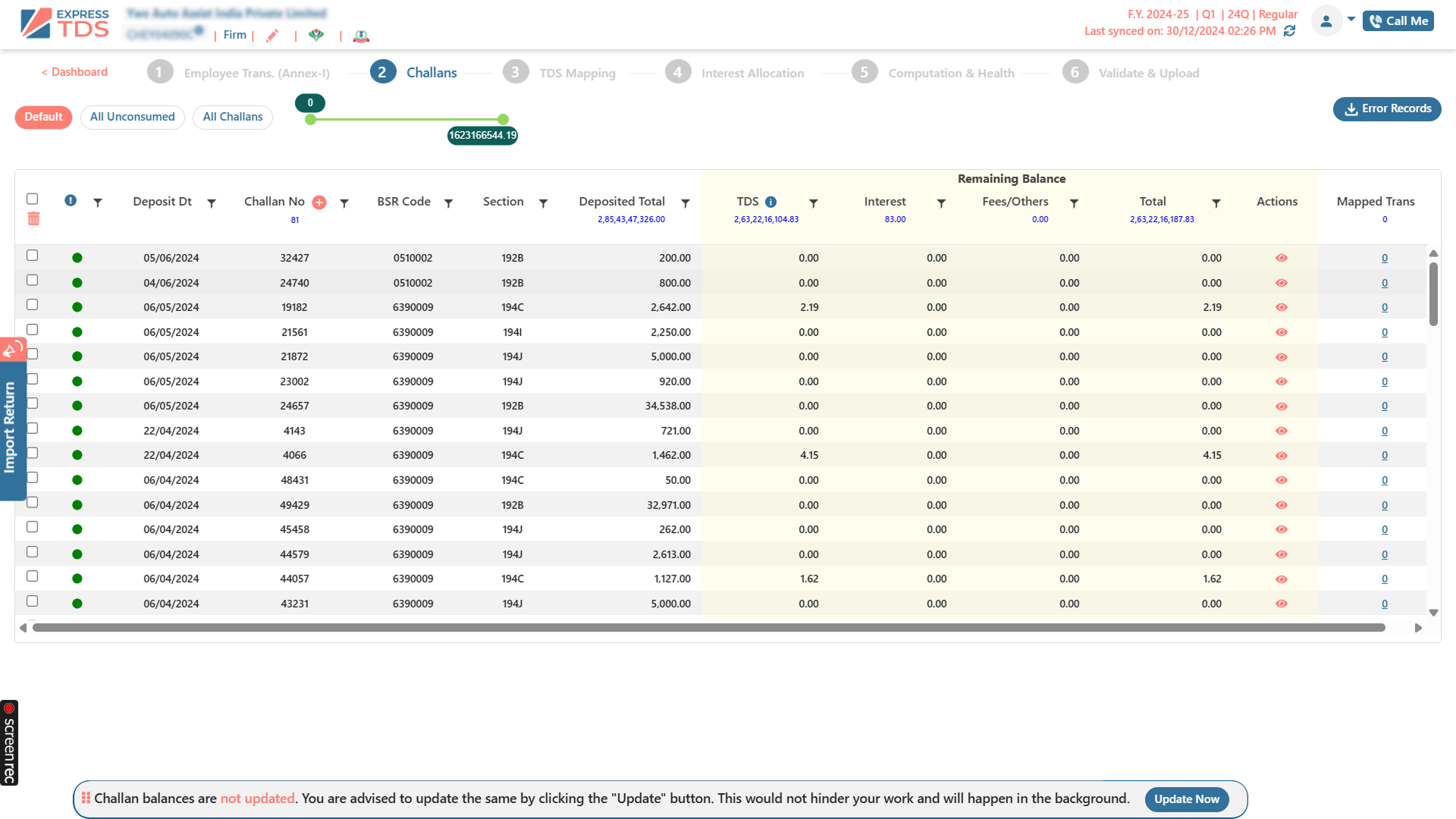

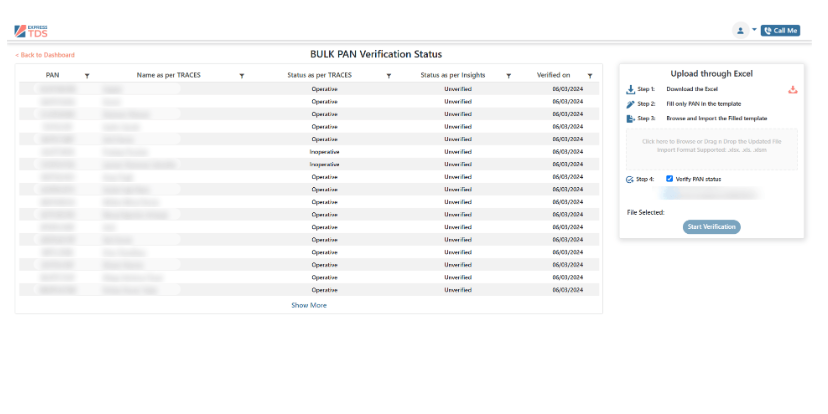

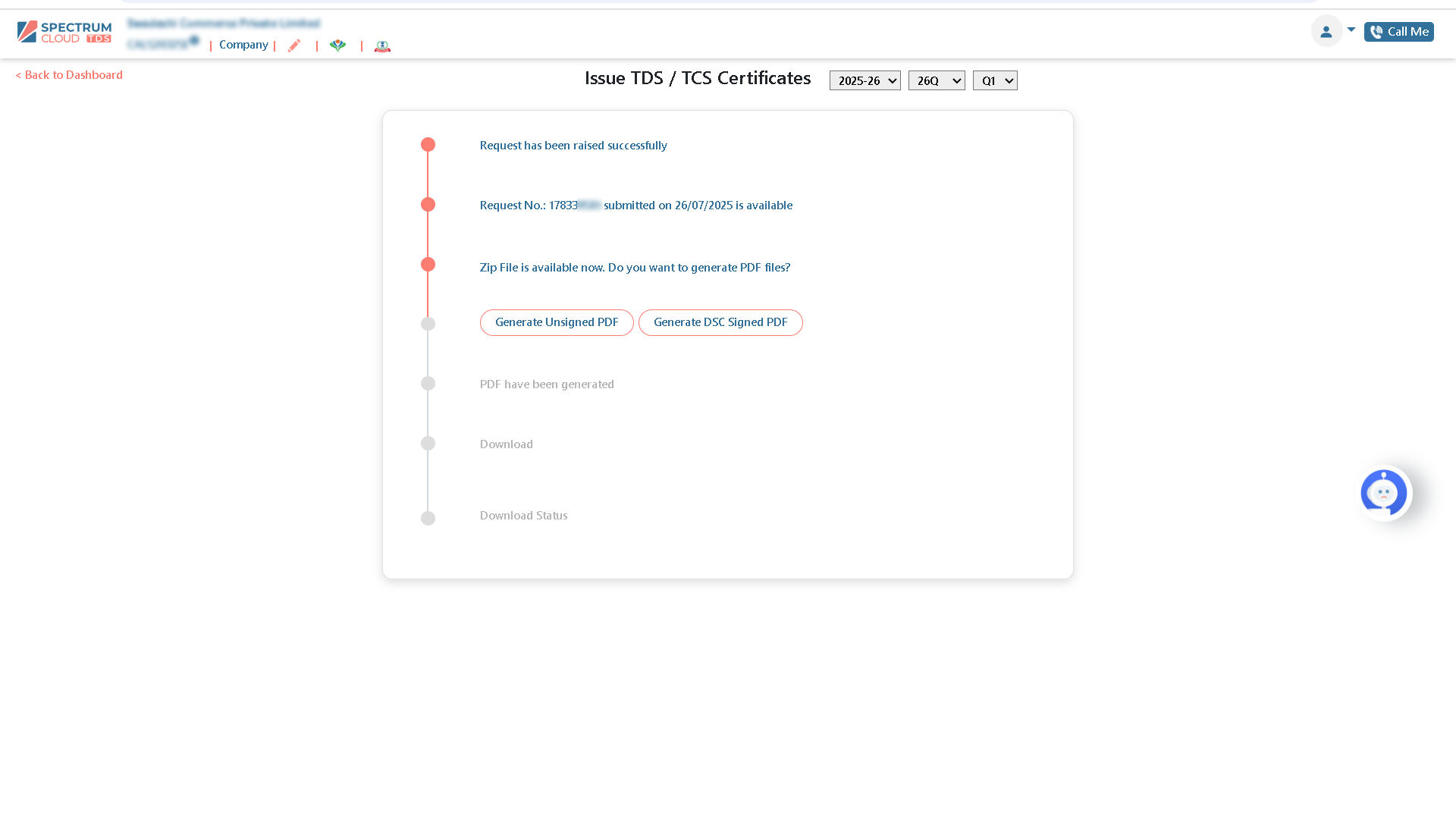

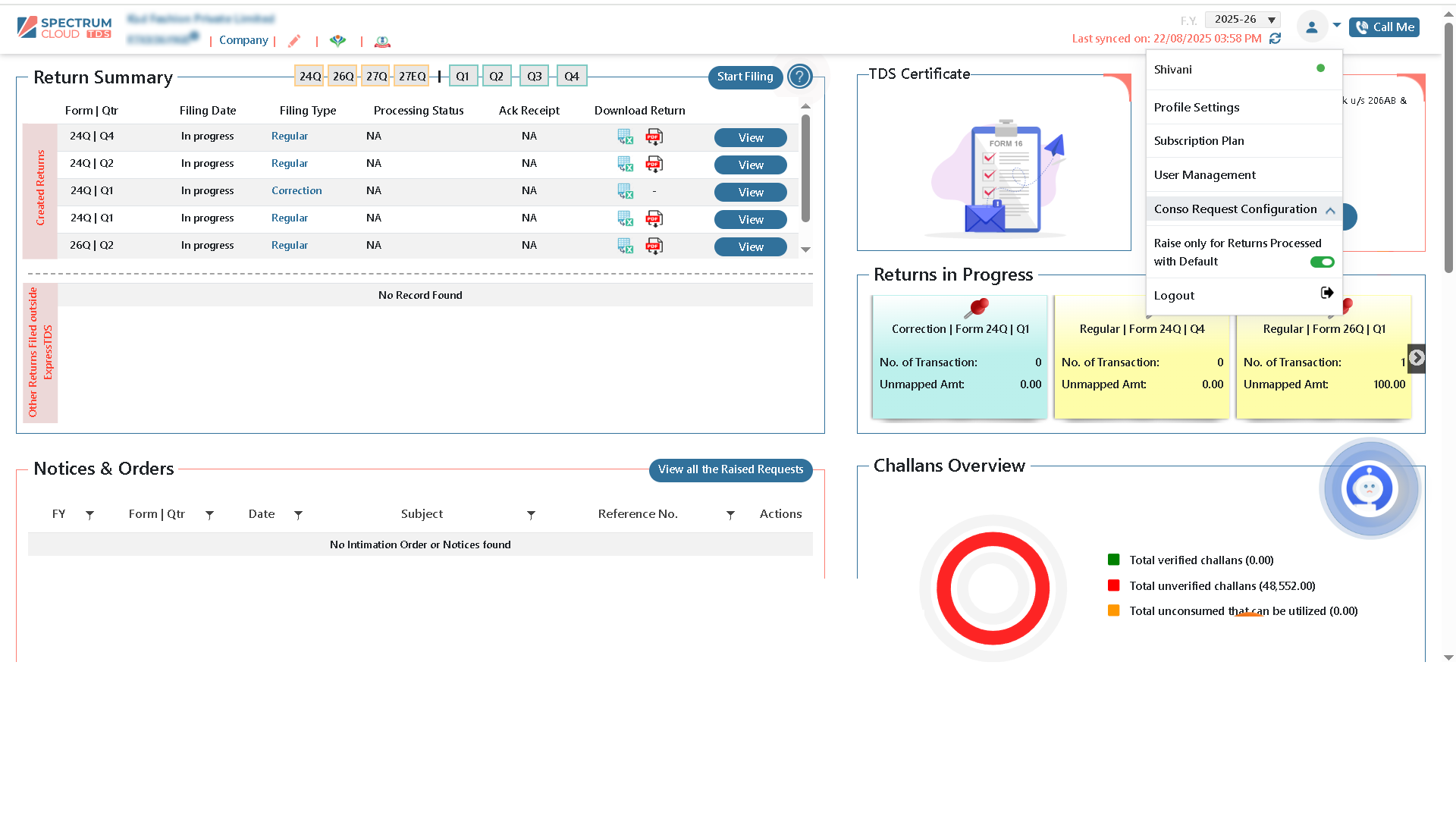

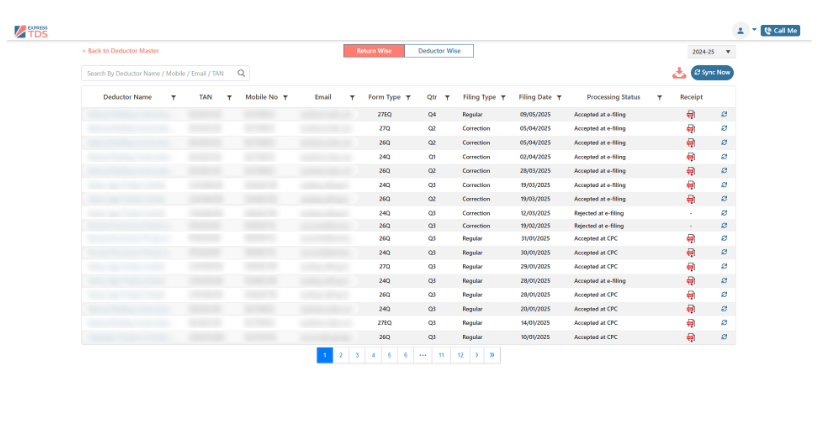

Seamless TDS Filing with Auto-Detect Short Deductions and Avoid Penalties, Large TDS Data, Sending Form 16 or

auto raise request..All Possible

Bank-Grade Enterprise Security

Your clients trust you with their data—so we’ve built our platform to meet the highest standards of security, privacy, and government-grade compliance.

SSL Encryption

We keep your sensitive client data secured with industry-standard 128-bit SSL encryption, ensuring safety of data at rest and in transmission over the web.

ISO 27001 Data Storage

All data stored in compliance with ISO 27001 standards, safeguarding your information with top-tier security protocols.

User Access Management

Assign full or restricted data access to team members ensuring secure, streamlined collaboration across your firm with precision.

VAPT Certified Security

Tested through rigorous Vulnerability Assessment and Penetration Testing (VAPT) to ensure our platform meets global standards in cybersecurity.

Your Certified Partner for Tax Compliance

Grow your practice without any worries, as all your clients' compliance is automated through government-authorised tax software partner.

GST Suvidha Provider (GSP) Certified

Certified by the Government as a trusted GST Suvidha Provider (GSP), guaranteeing reliable and compliant services.

Authorized ERI

Continuous audits and testing of our systems to identify and address vulnerabilities, maintaining the highest level of data protection.

Helping Our Customers Succeed

See how 1.5 lakh+ users are simplifying their tax compliance with us.

CA. Rajiv Bansal (Financial Advisor)

Their Support centre is Simply Amazing They Solve Your Problems in a Minute . I have some technical Isuue Their Representive Vishal bansal Solve my issues with in a

Gopal Agarwalla

"I Had Great Experience From Miss Khushboo Agarwal For Issue Related To KDK Tds Excel Export. She Had A Very Good Knowledge And A Very Kind Tone. That's Excellent Issue Resolve In Just Few Minutes. 5 Star For Support.",

Vishal Bansal

"Thank You So Much Really Fast Response From KDK Software Team Especially Vishal Sir Response Great Within Limited Time Period He Did Wonderful Task And Resolve My Problem Thank You Sir And Thank You KDK Software Team",

Saloni Jain

"1 Cloud Base Is Good 2 Can Used From Anywhere 3 Single Click GSTR1/ 3B Downloads. 4 2B Reco. 5. Auto 2B Email To Clients And Email Feature To Some More Points Demo Given By Your Person With Good Explanation And Example Live"

Khileshwar Sahu

"Awesome Support System. They Will Resolve Your Queries From All Perspectives. Some Of The Support Staff Are Very Cooperative. I Have Talked With Shyam. He Is Such A Nice And Kind Person. Thanks And All The Very Best",

Dhaval Pandya

"Nice Software Using For Last More Than 10yrs Since I Was Doing Articleship. Its Presentation Style Is Very Good In Compare To All Other Softwares In Market I Highly Recommend The Same.",

Ramesh Kumar

I wanted to take a moment to express my sincere appreciation for the outstanding support provided by your team. The response to my query was prompt, and the solution provided was clear and effective.

Manish Trivedi

Great experience. I learned how to use the software for reco with tally books and ims with software. It is really best. And i able to find errors, fix it and prepared accurate return. Mr. Gauran Gaur really took efforts and help me resolving the issue.

Shankara Narayanan

Express GST is good and demo was excellent. Need to use the product and explore further. After 1 year usage, I can confidently say it has all the basic reports and requirements . The speed of connection and data download from GST portal is good and was immensely useful in filing GSTR-9 & 9C for FY 23-24.

Rakesh Batra

Express GST is good and demo was excellent. Need to use the product and explore further. After 1 year usage, I can confidently say it has all the basic reports and requirements . The speed of connection and data download from GST portal is good and was immensely useful in filing GSTR-9 & 9C for FY 23-24.

K Maregowda

The training was very well-organised with a clear structure that made it easy to follow. Meenakshi effectively guided us through each step, ensuring we understand the core features of KDK Software.

Akash Gadiya

I've been using their TDS software and have been very impressed. The software is reliable and easy to use, and their customer support is excellent—responsive, helpful, and knowledgeable.

Vijay Kumar

I'm always appreciative of the support provided by KDK Software. Its always prompt and the issues get resolved. That was the reason for me to use their other products also like XBRL.

Jignesh Dudhat

While providing the services, they did it quickly and proactively. The software provides a wide range of IT and TDS Filing functions that are useful.

CA.Santosh Pathak

Excellent And Thanks For Karishma Mam Kdk Softwere In India Best Software For Income Tax E Filling Tds And All Others Tax Compliances.

Pratik Joshi

KDK Software is best software and fast service and solve the all problem quickly and friendly behavior. Technical team support is very good and solve the problem.

Badri Kharat

The support and help provided to me were excellent. I truly appreciate the assistance—it was the best experience I’ve had.

Bhavesh Sheth

Demo was very much help full in understanding features of GST Express Application by KDK.

K Selvam

Thanks KDK Software, Fast & clear supporting staff, thank you much helping form 16A generated, good support.

Anurag Maheshwari

Very nice service in all over India. Fast reply And Fast solution of problems Many many thanks to Special khan sir And all team of KDK.

Kamlesh Solanki

I am fully satisfied with HARSH SAINI Services provided me. He is very Soft spoken person and intelligent Personality. thanks

Corpdeck Info Solutions Private Limited

Quick response, right solution and feel good factor while using this software..thank you so much for supporting our business..!

Pallab Majumdar

KDK is one of the best software. Always you can get online support and they are every much helpful.

Eddanapudi Murali

The KDK Team have solved the problem in restoration of data. Very prompt service and i really appreciate them.

Kanchan Dey

Very good experience, software is very usefull for GST return filling or reconciliation purpose.

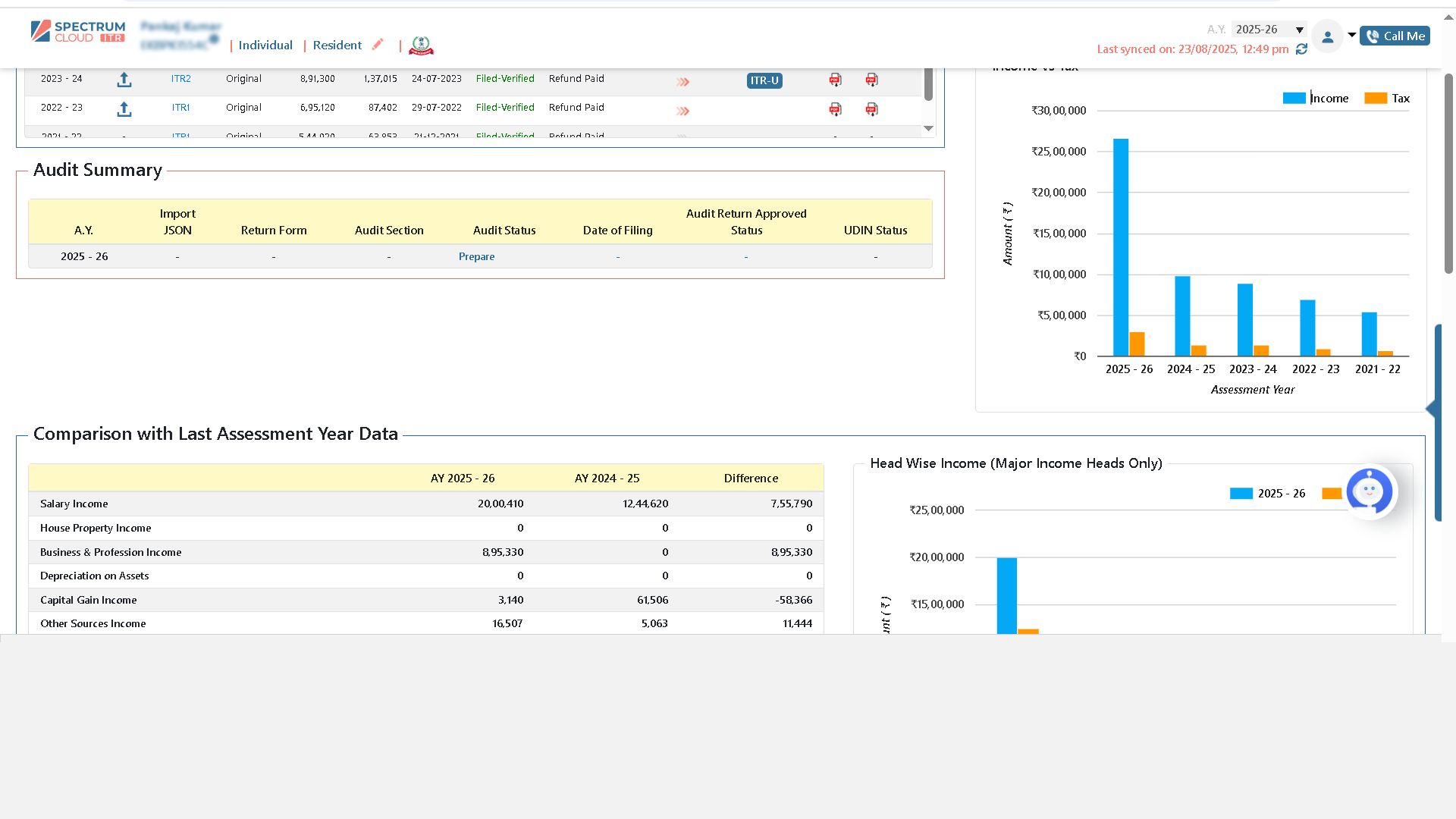

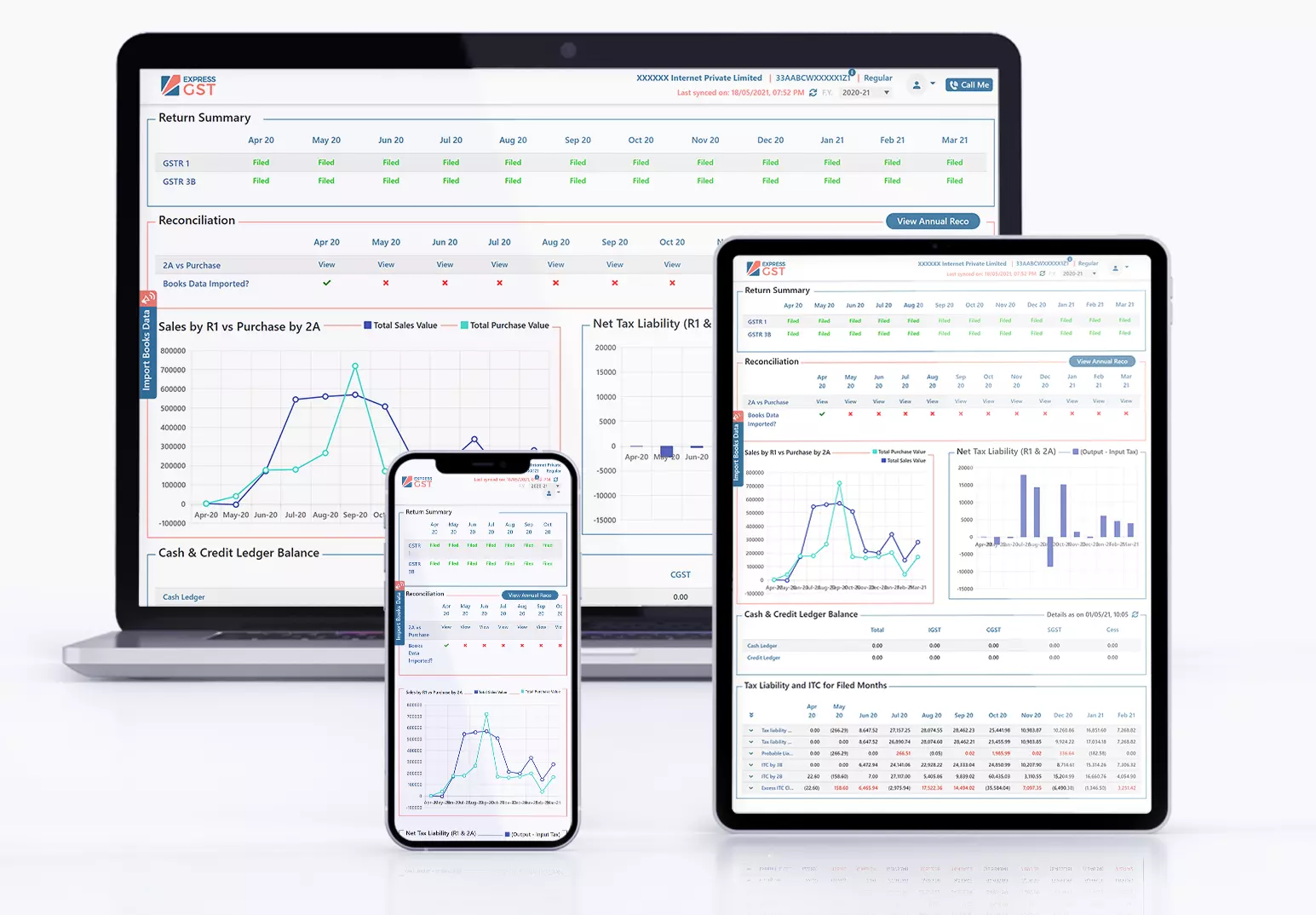

Welcome to Spectrum Cloud

India’s Leading Cloud-Based Tax Compliance Platform for GST, ITR, and TDS Filing

What is Spectrum Cloud?

Spectrum Cloud is an all-in-one cloud-based tax software developed by KDK Softwares India Private Limited and marketed by SNS Solutions Pvt. Ltd.. It simplifies return filing, reconciliation, and compliance management for professionals handling:

Fast & Reliable

File ITR, GST & TDS in just a few clicks with lightning speed.

Cloud-Based Access

Work from anywhere, any device, securely with cloud hosting.

Simplified Reconciliation

Auto-match data for faster, more accurate GST reconciliation.

Modules Available

- Spectrum Cloud GST Filing: https://spectrumcloud.in/GST/

- Spectrum Cloud Income Tax Return: https://spectrumcloud.in/ITR/

- Spectrum Cloud TDS Filing: https://spectrumcloud.in/TDS/

Spectrum Cloud Pricing Details

Spectrum Cloud pricing and subscription plans are available to registered users after login. For specific pricing queries, call us directly at +91 8292197860 or create your free trial account.

Questions & Answers

What is Spectrum Cloud used for?

Spectrum Cloud is a cloud-based tax software designed for professionals to manage and file GST, TDS, and ITR returns. It simplifies compliance processes with automation, reconciliation tools, and anytime-anywhere access.

How can I log in to Spectrum Cloud?

You can access your account by visiting the login page. If you are a new user, please register on the signup page.

Who developed Spectrum Cloud?

Spectrum Cloud is developed by KDK Softwares India Private Limited and marketed by SNS Solutions Private Limited. Together, they bring years of experience in tax and compliance automation.

How do I file a TDS return using Spectrum Cloud?

After logging in, go to the TDS module. The platform offers a step-by-step wizard to help you prepare and file returns like 24Q, 26Q, 27Q, and 27EQ quickly and accurately.

Where can I find pricing details for Spectrum Cloud?

Spectrum Cloud pricing is available to users after login. Simply log in to your account and view subscription options. For instant support, you can also call Spectrum Cloud Sales at +91 8292197860.

Need Help?

Call Spectrum Cloud team at +91 8292197860 or create your account to access all features.

Popular Search Keywords:

spectrum cloud, spectrum cloud login, spectrum cloud gst, kdk software, spectrum cloud tds, kdk tds login, cloud spectrum, spectrum cloud subscription price, spectrum-cloud, spectrum itr login, app.kdksoftware, how to file tds return in spectrum software, spectrum software price in india

Frequently Asked Questions

Spectrum Cloud is a complete tax software that lets CAs and tax professionals manage ITR, GST, and TDS filings from one secure cloud dashboard.

It’s designed for CA firms, tax consultants, and professionals who file returns for multiple clients and need speed, accuracy, and easy team access.

Yes. You can file income tax returns, GST returns like GSTR-1 and GSTR-3B, and manage full TDS compliance, including Form 16 generation and corrections.

Yes. Spectrum Cloud integrates with Tally and Excel to fetch client data automatically, even from the client’s system, reducing manual work.

Absolutely. It uses 128-bit SSL encryption, ISO 27001 data standards, and is VAPT certified for enterprise-grade security.

Yes. Spectrum Cloud allows multi-user collaboration with role-based access, so different team members can work securely and efficiently.

No. It’s fully cloud-based. Just log in from any browser and start working-no setup or installation needed.

Spectrum Cloud keeps track of GST and TDS notices from government portals and alerts you in real-time so you don’t miss important updates.

It auto-imports data, pre-validates entries, and files returns in just a few clicks-making the process 3X faster for CAs.

You can request a demo or sign up online. The platform is easy to use, and you can start filing in minutes.